You should consider our materials to be an introduction to selected accounting and bookkeeping topics, and realize that some complexities (including differences between financial statement reporting and income tax reporting) are not presented. Therefore, always consult with accounting and tax professionals for assistance with your specific circumstances. The notes (or footnote disclosures) are required by the full disclosure principle because the amounts and line descriptions on the face of the financial statements cannot provide sufficient information.

Consolidated income statement

It reflects the financial position of the entire group as a single economic entity. The balance sheet includes total assets, liabilities, and equity of the consolidated entity. Private companies have very few requirements for financial statement reporting, but public companies must report financials in line with GAAP. If a company reports internationally, it must also work within the guidelines laid out by the International Accounting Standards Board’s International Financial Reporting Standards (IFRS).

What are the requirements for a consolidated financial statement?

The equity method of consolidation is used when a parent has considerable influence over a subsidiary, typically assumed with ownership between 20% and 50%. The investment in the subsidiary is initially recorded at cost and is then adjusted to reflect the parent’s share of the subsidiary’s post-acquisition profits or losses. These adjustments affect both the carrying value of the investment on the balance sheet and the parent company’s net income. So, if Company A owns 35% of Company B, and Company B brought in $100,000,000, Company A would report $35,000,000 as income, affecting both its income statement and the carrying value of the investment on its balance sheet. Dividends received from the subsidiary reduce the carrying amount of the investment, reflecting the payout of assets, but are not recognized as revenue in the parent’s income statement. The main objective of consolidated financial statements is to help the users of financial statements make informed economic decisions.

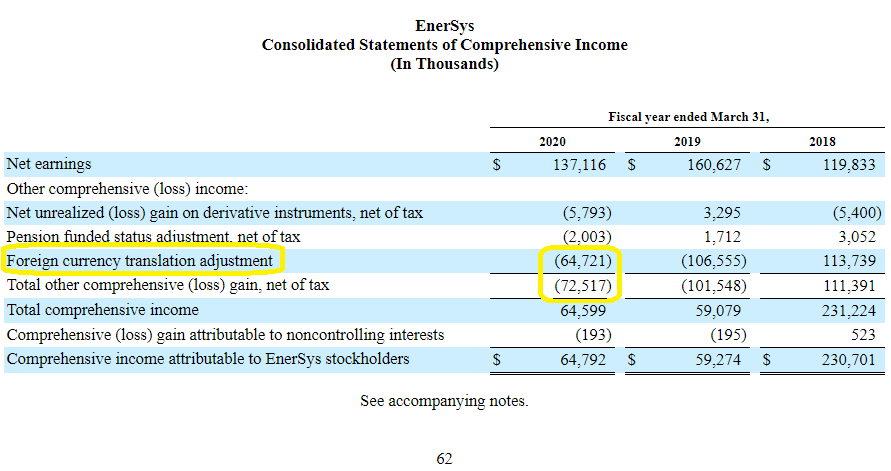

How to Interpret the Statement of Comprehensive Income (with Examples)?

Depreciation on fair value adjustments and impairment of goodwill is not examinable for this syllabus. Understanding the drivers of a company’s daily operations is going to be the most important consideration for a financial analyst, but looking at OCI can uncover other potentially major items that impact a company’s bottom line. The balance sheet of the same corporation will have as its heading “Consolidated Balance Sheets” consolidated statements of comprehensive income and will report the amounts as of the final instant as of December 31, 2023 and the final instant as of December 31, 2022. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory. Here’s a simple list of items included in the “Statement of Comprehensive Income.” To understand this, we must first pay heed to the opposite of comprehensive income.

6 Income statement and statement of comprehensive income

The Board would decide in each IFRS standard whether a transitory remeasurement should be subsequently recycled. You can learn more about other comprehensive income by referring to an intermediate accounting textbook. When a U.S. corporation’s shares of stock are traded on a stock exchange, we say that the shares are publicly traded or publicly held.

- The goal is to provide stakeholders with a clear understanding of how the company is performing as a whole, including any subsidiaries or related entities.

- The consolidated income statement shows the profit generated byall resources disclosed in the related consolidated statement offinancial position, i.e. the net assets of the parent company (P) andits subsidiary (S).

- Consolidated financial statements typically combine the financial data of a parent company and its subsidiaries into a single report.

In addition to the annual consolidated financial statements, the publicly-held corporation will issue quarterly consolidated financial statements. These are referred to as interim financial statements and will be more condensed (fewer details), reviewed by the registered CPA and will be part of the corporation’s Quarterly Report to the Securities and Exchange Commission (Form 10-Q). In addition to US GAAP the external financial statements of a publicly-traded U.S. corporation must comply with the reporting requirements of the U.S. government agency, Securities and Exchange Commission (SEC). Sophisticated investors and lenders will read closely the notes to the financial statements. If the corporation’s shares of stock are publicly traded, they will also read the additional information presented in the corporation’s Annual Report to the Securities and Exchange Commission, Form 10-K. With Prophix One, you can aggregate data automatically and build consolidated financial statements in less time and with no errors.

These are transactions between the parent company and its subsidiaries or between subsidiaries themselves. For example, if one subsidiary sells goods to another, this transaction must be removed from the consolidated reports to avoid overstating revenues or expenses. Eliminating these internal transactions ensures that the consolidated financial statements accurately reflect external operations. Once all entities have been identified, the next step is to gather financial statements from each subsidiary. These statements must be aligned in terms of the reporting period and accounting standards to ensure consistency. For instance, if a parent company uses IFRS but its subsidiaries report under GAAP, adjustments will need to be made so that all data can be consolidated under one framework.

The effect of intra-group trading must be eliminated from theconsolidated income statement. Such trading will be included in thesales revenue of one group company and the purchases of another. Back in June 1997, the FASB issued FAS130 on how to report comprehensive income. How a firm generates revenues and turns them into earnings is an important factor, but there are other important considerations.

However, make sure you read any other information with regards power to participate or other shareholdings (see illustration 5). The fair value of the non-controlling interest was $30,000 and the fair value of the net assets acquired was $125,000. Illustration (3)Purple Co acquired 70% of the voting share capital of Silver Co on 1 October 20X1. It is normal practice to instead adjust for the unrealised profit in inventory. An entity over which the investor has significant influence and that is neither a subsidiary nor an interest in joint venture. If any goods sold intra-group are included in closing inventory,their value must be adjusted to the lower of cost and net realisablevalue (NRV) to the group (as in the CSFP).

In the final part of the calculation, following on from the point just made, it is necessary to look at all (100%) of the fair value of net assets at acquisition. Again, this figure is given in this question and just requires slotting into our goodwill working. In other MTQs, you may be expected to do more work on finding the fair value of the net assets at acquisition. This could be asked as an OT question but is more likely to be a MTQ where you will be calculating and submitting a figure for each of the component parts of the goodwill calculation – cost, NCI and net assets. You should look at the specimen exam and extra MTQs available on the ACCA website. Illustration (2)Pink Co acquired 80% of Scarlett Co’s ordinary share capital on 1 January 20X2.

A crucial part of any consolidation, eliminating transactions between entities represented in the same statement, creates a more accurate view of the parent company’s financial position. If, for example, the parent company sells $100,000 worth of products to a subsidiary, this internal sale is removed in the consolidation to avoid inflating revenues and expenses. Adjustments for unrealised profitsAnother common adjustment that you could be asked to deal with is the removal of unrealised profit. This arises when profits are made on intra-group trading and the related inventories have not subsequently been sold to customers outside the group.

Leave a Reply